The 8th wonder of the world: compound interest Albert Einstein once called compound interest the 8th wonder of the world. Why? Because it has the power to turn small amounts into large ones over time, without requiring much extra effort. The concept is simple, but its impact is phenomenal—especially if you start early.

What is compound interest?

Compound interest is interest on interest. It works like this: you earn interest not only on your initial deposit, but also on the previously earned interest. This leads to exponential growth as time passes. The longer you let your money grow, the more powerful the effect becomes—making it particularly useful for long-term goals like retirement savings or wealth accumulation.

How does it work? A simple example

Let’s say you invest € 1,000 with an annual return of 5%:

Year 1: You earn € 50 interest (5% of € 1,000), bringing your total to € 1,050.

Year 2: You earn 5% on € 1,050, adding € 52.50. Your total is now € 1,102.50.

Year 3: Interest is calculated on € 1,102.50, earning € 55.13.

The longer you leave your money untouched, the greater the compounding effect. After 30 years, your € 1,000 grows to nearly € 4,321—without adding a single euro. That’s more than four times your original investment!

Why is time the most important factor?

The secret of compound interest is time. The longer you let your money grow, the stronger the interest-on-interest effect becomes. This makes it especially attractive for younger people who have decades before they need their savings.

Early vs. late investing: a huge difference

Person A invests € 5,000 at age 25 at a 5% interest rate and leaves it for 40 years without adding more. At age 65, they have € 35,200.

Person B waits until age 35 to invest the same amount at the same rate, leaving it for 30 years. At age 65, they have only € 23,200.

Starting early results in an extra € 12,000—just by giving the money more time to grow!

How can you benefit from compound interest?

Compound interest applies in many financial situations, such as:

Your salary growth. Most salaries increase by a percentage each year. A higher starting salary leads to a significantly larger total salary over time.

Example

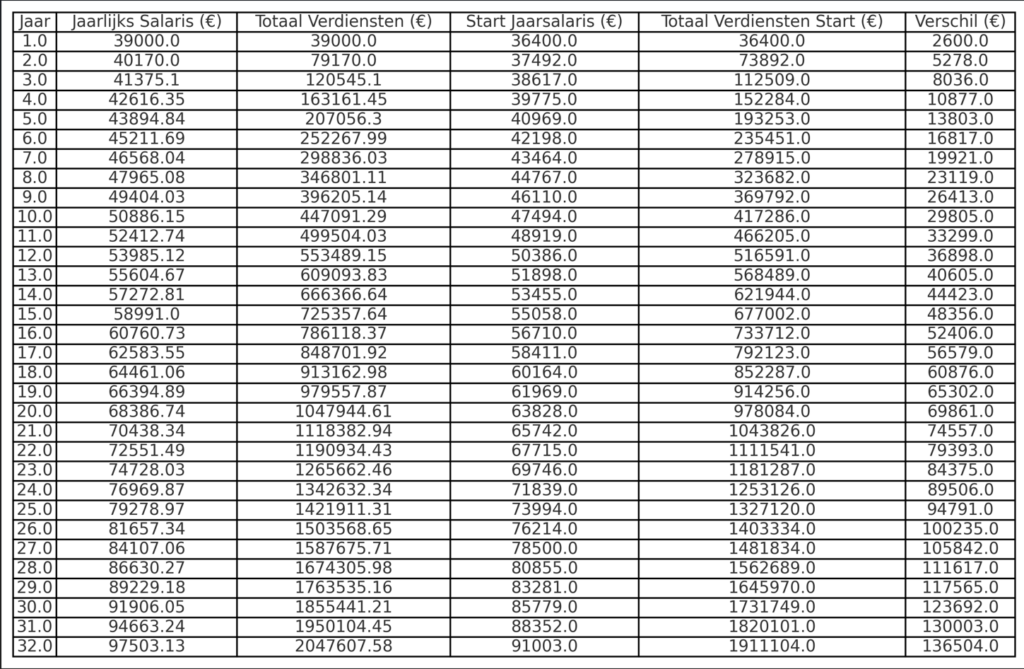

Below is a table with the yearly calculation, based on a starting salary of € 36,400 vs. € 39,000 per year. This equals a monthly salary difference of € 216.67. In this example, we assume a 28-year-old employee working for 32 years with an average annual salary increase of 3%.

The result? A total difference of € 136,507 over their careers!

Stocks and index funds – With an average return of 6-8% per year, long-term investments benefit massively from compounding.

Bank savings with interest – While interest rates are low nowadays, some banks still offer compounding benefits.

Pension plans – Long-term investments for retirement thrive on compound interest growth.

Conclusion: use the 8th wonder of the world to your advantage

Compound interest is a simple but powerful tool for growing your wealth. By starting early and having patience, you can maximize its exponential effect. An small investment today can make a massive difference over time.

Begin vandaag en laat het 8e wereldwonder voor jou werken!